Home / Management Discussion and Analysis

Group’s business and operations

Masteel’s principal business activities involve in the production of steel billets and steel bars which comply with the Malaysian Standard (MS 146:2016) for the construction sector. The Company has two (2) 100%-owned subsidiaries i.e. Metropolitan Commuter Network Sdn Bhd, currently dormant and MS Express Sdn Bhd which will be involved in transportation and logistics activities. Masteel also has an associate company, Bio Molecular Industries Sdn Bhd (“Bio-M”), which is a BioNexus certified company that manufactures and undertakes research and development of radioisotopes and radiopharmaceutical products which are used by hospitals for cancer imaging. These products are in full compliance with the Ministry of Health of Malaysia’s National Pharmaceutical Regulatory Affairs (“NPRA”) regulation and standards.

The manufacturing facilities of Masteel are located in Petaling Jaya and Bukit Raja, Klang, Selangor. The geographical presence of the sales of its steel bars are primarily in the Klang Valley, Johor and the East Coast of West Malaysia. Its radioisotopes manufacturing facility is located in Bandar Enstek, Negeri Sembilan. The main market for its radioisotopes are hospitals throughout Peninsular Malaysia.

The main driver of revenue for the Company is from the sales of steel bars and steel billets.

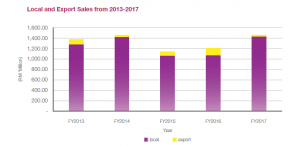

The distribution between local and export sales for the past five (5) years are as follows:

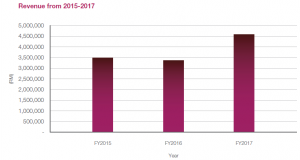

Bio-M, the associate company which manufactures radioisotopes for the imaging of cancer cells had recorded a turnover of RM4.59 million in Financial Year End (“FYE”) 2017 which is an increase of 36.16% from RM3.37 million in FYE 2016. In line with the increase in turnover and higher utilisation of the manufacturing facility, Bio-M’s gross profit also increased from RM1.41 million in FYE 2016 to RM1.99 million in FYE 2017.

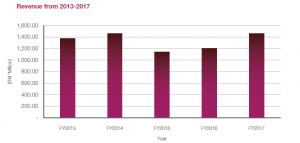

The sales revenue from steel bars in the past five (5) years is as follows:

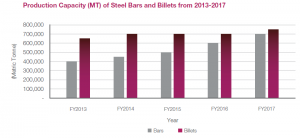

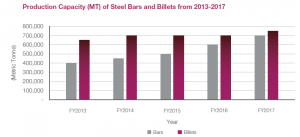

The production capacity of billets and bars are as follows:

Business objectives

The objective of the manufacturing activities is to maximize shareholders’ value through the generation of maximum profits by increasing sales volume and widening profit margin per MT with the utilisation of minimum overheads and capitals.

Whilst the Company is constantly striving to improve its output through the upgrading of its plant and machinery, it is also diligently looking towards establishing new strategic partnerships and joint ventures with other steel mills to increase its capacities and expand into other steel products for its home market and new markets in the ASEAN region.

Ongoing research and development on the technology and methodology to improve the efficiencies and reliability of the manufacturing facilities are key agendas for the management of the Company. For instance, a reduction in steel melting time will increase the billet production capacity besides reducing its energy used and the switch to using lower cost scrap which constitutes 60% to 70% of the production costs will enable the Company to keep the costs of production in check.

The Company possesses well trained and experienced workforce which are accustomed to the challenges of the cyclical nature of the steel business and the harsh working environment of the heavy steel industry.

The complexity of ensuring consistently high utilization rate of all manufacturing facilities is a major factor that can affect the costs and competitiveness of its products. The Company has in place a stringent and comprehensive training, inspection and maintenance programs with extensive incentives and penalty schemes to ensure the fullest compliance. Other external factors such as market pricing, exchange rate fluctuations and cost push factors are harder to mitigate and anticipate.

It is the business philosophy of the Company to be prudent when expending its financial resources and is constantly remaining vigilant and learned about future trends.

Financial Results and Financial Condition

Highlights of the Group’s key financial performance are as follows:

(a) For the year under review, the Group’s revenue increased by 21.26% to RM1.46 billion as compared to RM1.21 billion in the previous financial year. The increase in revenue was due to a higher sales volume coupled with better sales prices.

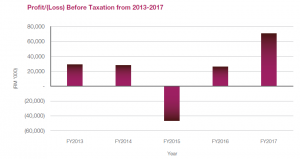

(b) In line with the improved revenue and sales margin of steel bars and billets, the Group’s profitability increased by 252% to RM75.46 million as compared to RM21.43 million in the previous year.

(c) The capital intensive steel making facilities’ output was driven by market demand, duration of festive holidays

and scheduled and unscheduled plant outages. Upon mastering the learning curve of the new Rolling Mill, which

produces premium size steel bars, Masteel managed to achieve 90% of the plant’s designed capacity.

The cyclotron at the radiopharmaceutical production facility recorded an improved sales output of radioisotopes from 103,520mCi in FYE 2016 to 111,242mCi in FYE 2017 (7.46% higher) due to more hospitals installing Positron Emission Tomography – Computed Tomography (“PET-CT”) scanners throughout Central and Southern Peninsular Malaysia. The production run has also increased from 167 in FYE 2016 to 181 in FYE 2017.

The financial outcome of the Group other than being driven by the above capacities is also affected by actual sale volumes, selling price and input raw material costs. In addition, the magnitude of energy cost increase, labour and financial costs will also affect the final financial outcome of the Group.

The tactical business direction is to further improve the output of the steel making plants by maximizing the existing equipment coupled with the installation of a new facility will eventually increase the billet production capacity by

approximately 100,000 MT per year. The objective of the above strategy is to achieve a higher level of economies of scale that would reduce the total costs of production and improve the bottom line. The concurrent improvement of its sales volume will be to target distributors and dealers that supply to the various mega infrastructure projects.

The following are the risk factors that could affect the financial performance of the Company:

1) Slower demand of bars due to weakness in the domestic property sector is expected to be offset by the rolling out of the Malaysian government’s various infrastructure projects and spending. Prominent mega infrastructure/construction projects that have been announced which are in progress or about to be implemented include the KL-Singapore High Speed Rail, East Coast Rail Link, Pan Borneo Highway, Light Rail Transit 3, Gemas Johor Baru rail link, Mass Rapid Transit Circle Line and the MRT 2. [Source:https://www.thestar.com.my/business/business-news/2018/02/03/steelrecovery-seen-sustainable]

2) Any potential increase in costs will be mitigated by striving for higher output with the implementation of new technology packages and manpower retraining.

3) Foreign exchange volatility risk will be mitigated through constant monitoring of the foreign exchange market and the Company’s overall forex exposure.

4) The steel tariff of 25% announced by Donald Trump’s administration in early 2018 is not expected to have a substantial effect on the Company as Masteel does not export its steel bars to the USA. Export sales only constitutes 2.50% of total sales for FYE 2017.

5) The commencement of a foreign owned steel mill in the east coast is not expected to pose a significant risk as

substantial amount of their production output is required to be exported.

Financial section of the company

1) During the year under review, the global selling prices and the momentum in the increase of the selling price of steel bars continues to be sustainable in line with the stronger domestic demand of steel bars due to an expediated pace in the rolling out of infrastructure and construction projects. Furthermore, with the imposition of the safeguard duty of 13.42% by the Malaysian government on imported long steel products, the demand of our locally manufactured steel bars had also increased. Consequently, the Company’s turnover for the FYE 2017 had also increased by 21.26% to RM1.46 billion as compared to RM1.21 billion in FYE 2016.

2) Resulting from the improved selling prices and sales margin of steel bars coupled with a higher foreign exchange gain resulted from the strengthening of the Ringgit Malaysia as compared to a foreign exchange loss of RM7.78 million in the FYE 2016, the Company achieved a profit before tax of RM70.89 million in the FYE 2017 as compared to a net profit before tax of RM24.68 million in the FYE 2016.

3) In the FYE 2017, the Company’s trade receivables increased by 22.08% to RM183.86 million from RM150.61 million in the previous year mainly due to an improvement in our sales volume. For the year under review, the average collection period remained at 45 days.

4) In the FYE 2017, the Company’s average trade payable days had improved from 64 days in FYE 2016 to 53 days for the year under review primarily due to an improved payment process to our core and critical suppliers in order to foster a stronger trade relationship.

5) Due to the improvement in our credit payment process, our cash balance and short term deposits had decreased by 14.22% from RM60.71 million in FYE 2016 to RM52.08 million in FYE 2017.

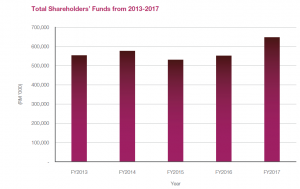

6) In line with the Company’s commendable performance, the Company’s shareholders’ funds had also increased by 17.59% to RM648.84 million for the FYE 2017 as compared to RM551.77 million in the previous year. The increase was mainly attributable to an increase in retained profits and a private placement exercise of new shares.

a. Due to the Company’s favourable performance for the year under review, the retained earnings had increased

from RM352.21 million in FYE 2016 to RM427.68 million in FYE 2017.

b. The Company had also carried out a private placement exercise in two (2) tranches during the year. For the

year under review, a total proceed of RM20.42 million was raised from a total of 19,500,000 ordinary shares

which were listed and quoted on the Main Market of Bursa Securities. The purpose of the exercise is for the

repayment of the Company’s credit facilities which resulted in a reduction of debt for the Company.

c. The remaining variance is attributable to a gain of RM597,000 arising from disposal/cancellation of treasury

shares totaling RM584,000 at cost.

7) As a result from the repayment of the Company’s credit facilities through the private placement proceeds, the

Company’s gearing ratio was reduced from 0.66 times in FYE 2016 to 0.55 times in FYE 2017.

FORWARD LOOKING STATEMENTS

In line with China’s continuing anti-pollution campaign to deal with its environmental issues, China had announced that the country will continue its plan to further phase out its steel production in 2018 in line with the original plan to reduce 150 million MT of steel production capacity by 2020. As China’s steel production and exports continue to decline, we expect stable steel prices for the year ahead and the domestic steel demand to remain firm.

The steel tariff of 25% announced by Donald Trump’s administration in early 2018 is not expected to have a substantial effect on the Company as Masteel does not export its products to the USA. Historically, the Company’s export sales, mainly to Australia and Indonesia, constitutes less than 13% of the Company’s total sales. The risk of the excess quantities, due to the above implementation of US steel tariff, being offloaded at low prices in the Malaysian market is low due to existing import duty of 5% and the additional safeguard tariff of 13.42%. The continuation of the safeguard duties for the next three (3) years remains a significant event that will stabilise the Company’s earnings performance for the next few years.

On the domestic front, a new foreign owned steel mill in the east coast is expected to commence its operations within the year. However, substantial amounts of their production output are slated for export. The remaining quantities are expected to be well absorbed by the local market. With the rolling out of the Malaysian government’s various mega infrastructure/construction projects, the demand and selling prices for the steel products is expected to be well supported.

With the installation and operation of the new equipment in 2018, the Company will be able to increase its production of steel billets by 50,000 MT in 2018 and 100,000 MT in subsequent years. The anticipated improvement in the output of the new equipment will earn the Company an additional revenue of approximately RM100.0 million, equivalent to an increase of 7% in revenue for the year ahead.

In the radiopharmaceutical division, the quantities of radioisotopes to be sold is expected to grow organically to

122,000mCi from 111,242mCi. Bio-M is expecting three (3) new customers in the year 2019 which will consequently increase its orders by 20,000mCi.

It is widely expected for the interest rates to rise in the year ahead due to the Federal Open Market Committee raising its federal funds target rate range. In order to mitigate this risk, the Company will explore switching its floating-rate borrowings to fixed-rate borrowings. The Company will also consider raising fixed-rate borrowings should the need arise.

In line with the improved financial performance of the Company, the Company will strive to adhere to its 10% dividend payout on its profit after tax.